News & Events

January 2026 | Join us as we celebrate our 91st Annual Meeting & Elections!

The 2026 Annual Meeting of Destinations Credit Union will be held on Thursday, March 19, 2026.

Please join us as we look back at our year in review as well as discuss future plans for the Credit Union. The business meeting will begin promptly at 5:30pm. Light refreshments will be provided for the evening. Visit the News & Events section of our website for future updates.

Meeting Information

Thursday, March 19, 2026

5:00pm – 6:30pm

Holiday Inn Express Towson–Baltimore North

1100 Cromwell Bridge Road

Towson, MD 21286

Board of Directors Election Update

On January 15, 2026, the Board approved the Nominating Committee’s candidate nominations. For the seats open for election to the 2026 Destinations Credit Union Board of Directors, the election will be by acclamation at the annual meeting on March 19, 2026.

The candidate/incumbent is:

- William Lovelace

November 2025 | Fee Schedule Update

We have made updates to our Fee Schedule, which take effect on January 1, 2026.

October 2024 | Let’s Celebrate International Credit Union Day – Oct. 17!

What is International Credit Union (ICU) Day®?

ICU Day has been celebrated on the third Thursday of October since 1948 and is designed to create awareness and celebrate the ways credit unions improve the lives of their members around the world. This year’s theme “One World Through Cooperative Finance” – signifies how credit unions bring people together and provide a safe, convenient place to save money and access loans at reasonable rates.

Credit unions are not-for-profit financial cooperatives that provide an effective and viable alternative to for-profit financial institutions for more than 403 million members in 98 countries worldwide. More than 82,000 credit unions exist globally, providing a plethora of financial services for their members, recognized as a force for positive economic and social change.

Join Us to Celebrate

In honor of our members, we’re hosting a celebration at our branches.

When: Thursday, Oct. 17, 2024

11:00am – 1:00pm

Where: Destinations Credit Union’s Satyr Hill Branch and Northwest Hospital Branch Locations

What: Enjoy refreshments, sweets, and small giveaways.

April 2024 | Fee Schedule Updates, Effective May 1, 2024

As you may have seen referenced in your statement message yesterday, Destinations Credit Union will be making some updates to our current fee schedule.

These changes will become effective May 1, 2024 and this email notice serves as a replacement for the statement insert that was not included with March e-statements.

You may view the Updated Fee Schedule here.

Thank you for your continued membership.

February 2024 | 2024 Scholarship Program is Now Accepting Applications!

College-bound members are eligible to apply for one of ten $1,000 essay-based scholarships and one of two $1,000 video-based scholarships.

And, yes, you may apply in both categories!

Deadline for applications is 11:59 P.M. on April 15, 2024. Scholarship winners will be announced in June 2024.

Learn more about this year’s topics for essay and video applications.

January 2024 | Annual Meeting & Election Notice

The 2024 Annual Meeting for Destinations Credit Union will be held on March 21, 2024.

Please join us as we look back at our year in review as well as

discuss future plans for the Credit Union. The business meeting will

begin promptly at 5:30pm. Light

refreshments will be provided for the evening. Check back here for future updates.

Meeting Information

Thursday, March 21, 2024

5:00pm – 6:30pm

Holiday Inn Express Towson–Baltimore North

1100 Cromwell Bridge Road

Towson, MD 21286

Board of Directors Election Update

On January 18, 2024, the Board approved the Nominating Committee’s

candidate nominations. As there three (3) seats open for election to the

2024 Destinations Credit Union Board of Directors, with only two (2) of

the three (3) incumbents opting to re-run, and with no additional

candidate applications, the Nominating Committee officially nominates

the following member applicants:

- George Hamilton, Jr.

- John Davidson

December 2023 | Northwest Hospital Branch Entry Update

We’ve recently been informed of an updated process to visit our Northwest Hospital Branch.

ALL members must enter by coming through the front main lobby, where they will need to provide Identification and obtain a sticker badge.

View complete locations & hours information here.

May 2023 | By-law Amendments

Amendments to Destinations Credit Union By-laws were approved by the membership during the Annual Meeting held March 16, 2023 and subsequently submitted to the Office of the Commissioner of Financial Regulation for the State of Maryland. They were granted final approval by the State and are in effect as of May 31, 2023.

View By-law Amendments Here

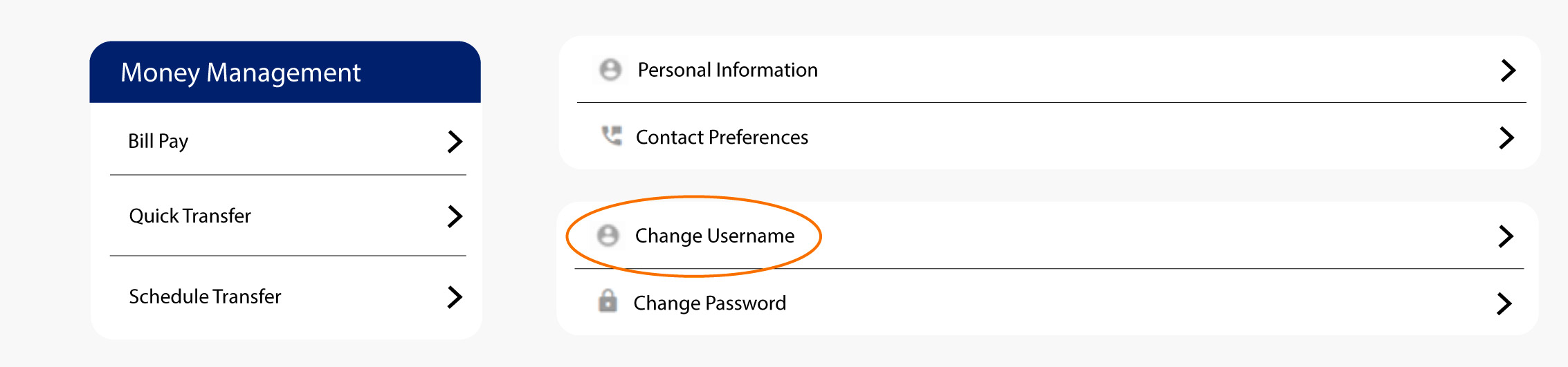

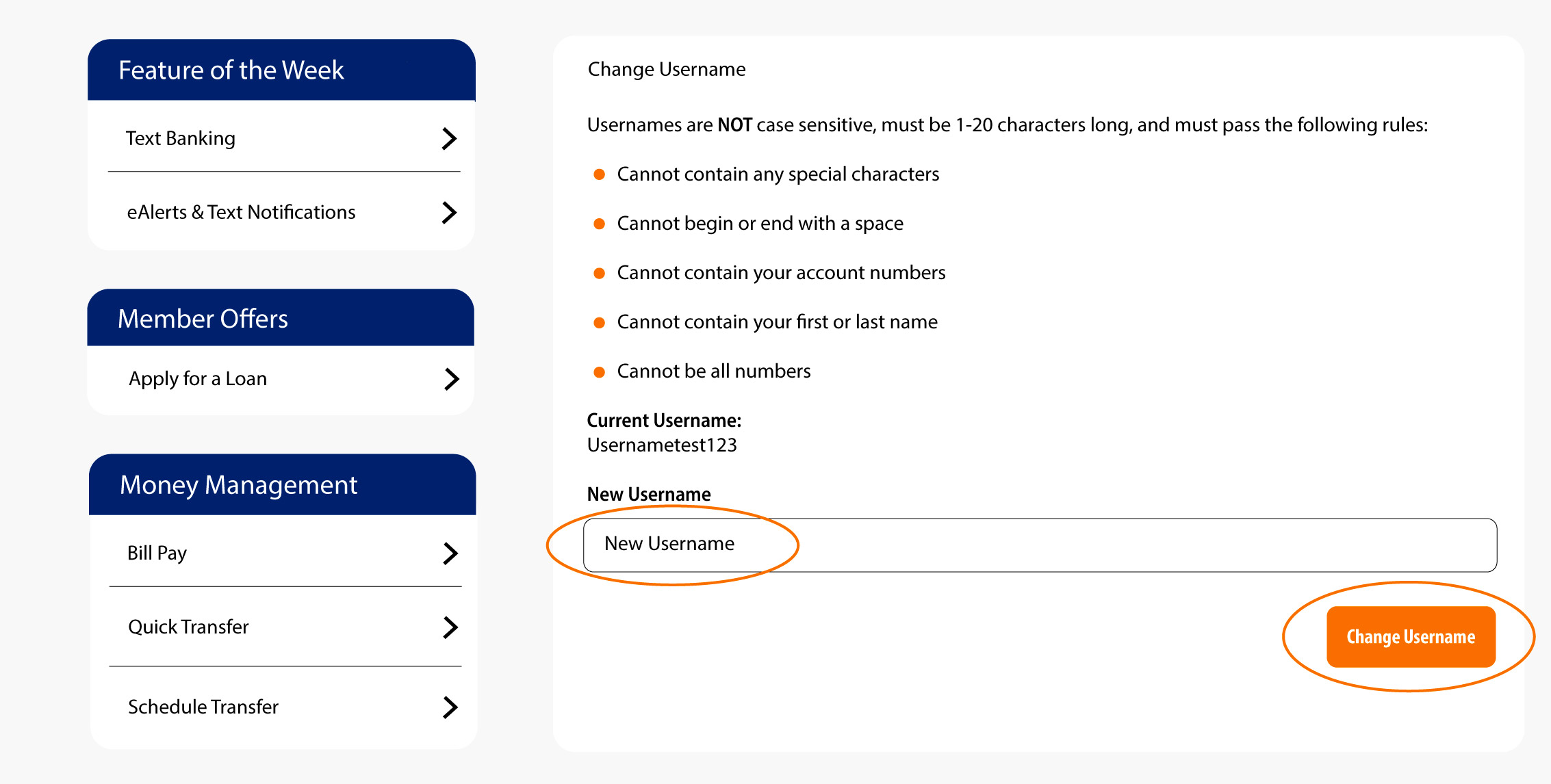

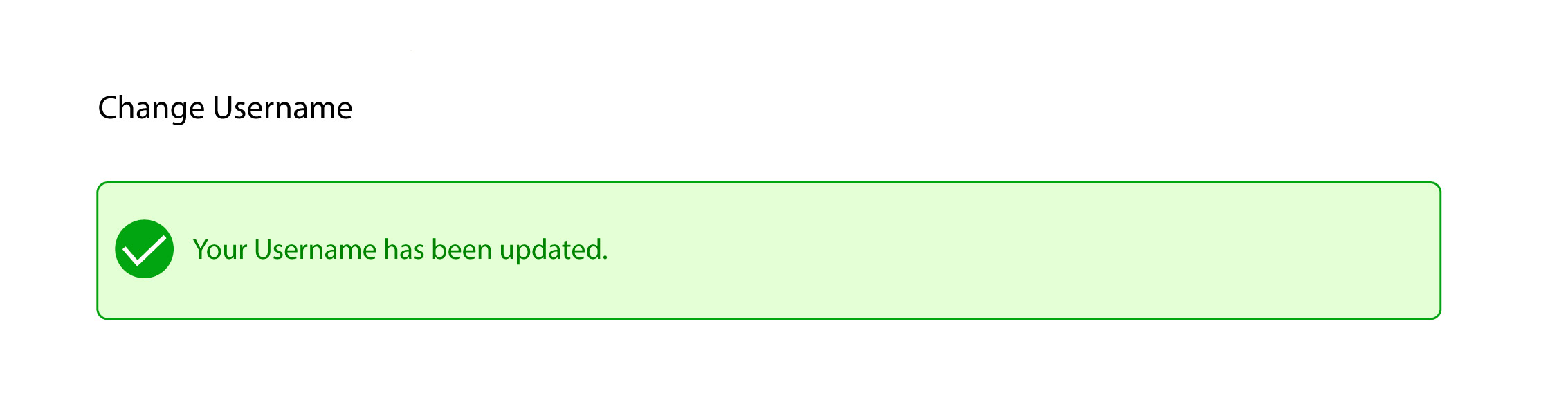

October 2022 | Action Required for Your eBanking Login ID

Destinations Credit Union is bringing new features and security changes to eBanking (Online banking) and mobile banking (mobile app).

For security purposes, you are required to update your eBanking login ID if it is your membership number to another username that does not include your membership number or any portion of your name.

Creating a unique username provides you with additional security as identity thieves are less likely to see and steal your account or member number.

Update your username by following the steps below:

https://beta.itsme247.com/274/authentication/username

July 2022 | Paper Statement Charge to Increase

In August 2022, the new charge will be $10/month due to cost increases and supply chain issues. Avoid the fee by enrolling in eStatements today in It’s Me 24/7. eStatements are FREE.

Click here for detailed instructions on How to Enroll in eStatements

The paper statement charge will be pulled from available balances tied to membership (any share). Insufficient funds can take the account negative.

June 2022 | Skip-A-Pay Update

Destinations Credit Union is dedicated to helping our members improve their financial lives. While we have currently discontinued our seasonal skip a payment program, we remain committed to supporting you. If you are encountering any financial concerns with your accounts, we encourage you to apply for assistance through our Lending Service Center. If you have further questions please call us at 410-663-2500 ext. 122.

March 2022 | Branch Update

Due to ongoing Covid concerns and limited staffing:

Effective Monday March 14th, until further notice, our Satyr Hill lobby will be open on Mondays, Wednesdays, & Fridays. The Drive-thru will be open Monday thru Saturday with normal business hours. Our Northwest Hospital branch lobby will be open on Thursdays only at this time.

We are dedicated to ensuring the safety of our employees, members, and communities, while continuing to satisfy your financial needs, by following the guidance from the CDC and the State of Maryland.

We apologize for any inconvenience & thank you for your membership.

You can continue to access your accounts through our convenient 24/7 eServices:

- Surcharge-Free ATMs (On-Site)

- eBanking & Bill Pay

- Mobile Banking with Mobile Deposit via our Mobile App

- Moli

- Audio Teller

March 2022 | Women’s History Month

March is Women’s History Month! Check out this new online research guide, which highlights hundreds of sources that tell the stories of women through a wide variety of perspectives and media in the Library of Congress collections: https://womenshistorymonth.gov/

February 2022 | Black History Month

Looking for ways to celebrate Black History Month? Check out these upcoming, local events:

Maryland Black History Month Events

July 2021 | Fraud Prevention Alert

Be sure to take caution when dialing the activation number for your new card. Unfortunately, fraudsters are always looking for opportunities and it’s come to our attention that one of their newest schemes is to pose as an activation line using phone numbers that are similar to secure activation lines (typically just one digit off, so they can easily be misdialed by unsuspecting members). If you do happen to misdial and a representative asks for your card information or promises you’ve won some sort of prize, please hang up and call Destinations Credit Union or your other card issuer directly for assistance.

News

Newsletters

Equal Opportunity Lender | Insured by NCUA *1.99% Promotional APR applies to balance transfers completed between 9/1/2022 and 10/31/2022 and expires 12 billing cycles from the date of first transfer for existing cardholders. New cardholders enjoy 1.99% APR for the first 12 billing cycles from the date the card is opened on purchases and transfers. A regular APR (between 9.50%–19.5% based on your credit) applies to all other transactions and unpaid promotional balances remaining after the promotional period ends. Interest on transfers begins to accrue immediately. You must use the balance transfer form linked from our website at www.destinationscu.org/balance-transfer to complete transfers. Click on the balance transfer form link above. Contact the Credit Union for details.